- STANDARD ACCOUNTS PAYABLE POLICIES FULL

- STANDARD ACCOUNTS PAYABLE POLICIES SOFTWARE

- STANDARD ACCOUNTS PAYABLE POLICIES PROFESSIONAL

Clearly communicated expectations and a flexible approach, teamed with a commitment to transparency, can help you build successful and enduring strategic partnerships.

STANDARD ACCOUNTS PAYABLE POLICIES SOFTWARE

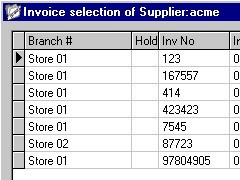

So if you don’t already have a comprehensive procurement software solution in place, research and implement one, either as your main software or in tandem with existing Enterprise Resource Planning (ERP) software. The potential savings afforded by improved accounts payable procedures are substantial, but require total integration and transparency to be fully realized. Duplicate payments, late payments, lost delivery receipts, missing original invoices or incorrect invoice amounts are just some of the potential chinks in your AP armor that can be addressed by a well-implemented payable system. Once you’ve set up a real-time AP system that makes complete transactional information immediately available, it becomes much easier to spot, and eliminate, potential errors. It also simplifies internal audits, forecasting, and financial reporting. This singular process improvement lets you build policies, practices, and hierarchies that support your overall procurement strategy, with fewer roadblocks and greater efficiency.

STANDARD ACCOUNTS PAYABLE POLICIES FULL

Plus, inside and outside of AP, when every stakeholder has full access to the information and documents they need to ensure prompt orders, approvals, and payment, your whole company benefits. AP automation means your accounts payable staff isn’t bogged down with manually tracking every paper invoice and delivery receipt.

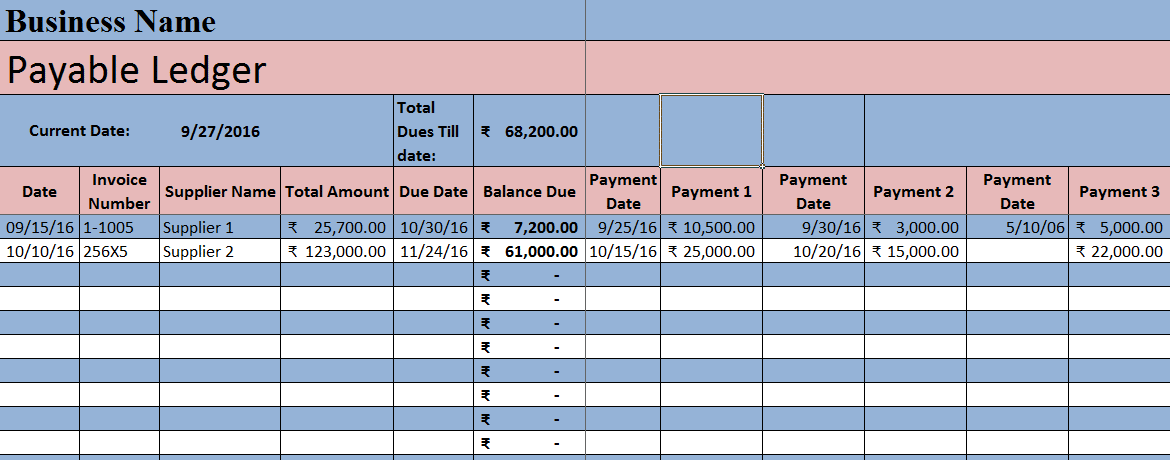

Tracking vendor performance goes hand in glove with tracking your own payment data and behaviors, including invoice processing, late or early payments, cross-referencing purchase orders to invoice numbers, and more.

Strong internal controls are a good start for any successful AP system, but you’ll need some more robust strategies to get the most from your accounts payable department. Essential Accounts Payable Best Practices You’ll also avoid costly fees and penalties, which means your company will have more available working capital-not to mention healthy and rewarding relationships with creditors and vendors alike. When you develop and implement accounts payable best practices, you’ll find you have fewer time-consuming errors to correct. To be truly effective, every part of your accounts payable system should support your company’s overall success by ensuring vendors and creditors receive correct payment in a timely fashion. Why Developing Effective Accounts Payable Processes Matters

STANDARD ACCOUNTS PAYABLE POLICIES PROFESSIONAL

Invest the necessary time and resources into smart and professional policies that pay for themselves in lower costs and added value. How you manage your accounts payable processes can have a huge impact on not only your bottom line, but your cash flow, creditworthiness, and reputation.įortunately, implementing best practices for accounts payable is a straightforward affair. Paying the piper may not be the most enjoyable aspect of doing business, but accounts payable (AP)-like every part of a successful company-has an important part to play in keeping your organization profitable, growing, and competitive.

0 kommentar(er)

0 kommentar(er)